Day trading from your smartphone enables you to buy and sell quickly, but if you see market changes that spur you to trade, take a step back. Credit Cards. Read full review. If you check your stocks and see prices dropping, these changes might tempt you to sell quickly to avoid any loss. Any smartphone app for trading offers many great features but lacks the full functionality of a financial institution’s Web site on your computer. Real Money Pro Portfolio.

Access to financial markets has never been easier

We are committed to researching, testing, and recommending the best products. We may receive commissions from purchases made after visiting links within our content. Learn more about our review process. Buying and selling stock investments used to require a phone call to a stockbroker who would charge you an arm and a leg to execute your stock trade. Follow along for reviews of the best traed trading apps and may the market forever be in your favor.

Our ranking of the best brokers for the mobile-first movement

With extended hours overnight trading, you can trade select securities whenever market-moving headlines break—24 hours a day, five days a week excluding market holidays. We’ve expanded our after-hours lineup to cover more international markets and sectors like tech, so you can access even more of the market around the clock. With news breaking overnight, today’s highly connected world requires a way to react right when market moving events happen. Regular market hours overlap with your busiest hours of the day. Now you can access the markets when it’s most convenient for you, from Sunday 8 p. ET to Friday 8 p. These securities were selected to provide access to a wide range of sectors.

As a day trader, you can be your own boss. You can trade from an office or at home, or even while travelling — thanks to advances in mobile technology.

But oost trading is not for everyone, and there are some things you should be aware of before you start day trading the financial markets. In this guide, we discuss day trading for beginners and some key things to remember. The idea of day trading has increased in popularity over recent years. Technology has played a big part in this — thanks to fast broadband and mobile connections we have a wealth of trafe market information at our fingertips.

This has led to many more people accessing the markets through day trading, in other words, placing trades throughout the day to try and profit from volatility as market prices go up and. But what strategies can you use?

Should you keep it simple, or use something a bit more complicated? Day trading is powt popular short-term trading strategy, which involves the buying and selling of ray instrumentswith the aim of closing out of the positions by the tradee of the day to profit from small movements in price. Day trading strategies can differ from longer-term trading strategies, in that they focus more on profiting from shorter-term movements in the market, as opposed to moves that take place over a number of days or weeks.

Day traders need to be continuously focused, as markets can move suddenly in the short term. These traders prefer not to load posst charts with lots of different indicators in order to try and second-guess app to post day trade. Rather, they will trae solely on price; this is often referred to as ‘price-action trading’. When trading in this way, you still have some key reference points based on what has happened previously, to help you plan future trades.

This is actually quite logical: yesterday’s high marked the point where sentiment changed and the sellers came back into the market, pushing the price lower. The market consensus, therefore, was that the price was too high. And of course, the previous day’s low shows where the buyers regained confidence as they felt the market was undervalued — pozt voted with their wallets and bought.

These levels could be important if they come into play again, and can provide the cornerstone of a day trading strategy. During the previous day, when the price dipped back to the 1. Of course, there was no way of knowing what would happen on 22 April, but there was a reasonable chance that 1. The expectation would be for buyers to step back in again ahead of that 1. As can be seen in the chart, this is exactly what happened.

The day trader would consider buying here as there had been demand on the previous day. Another big advantage of using absolute levels like this to plan trades is the all-important management of risk.

Day trading is of course all about trying to make profits, but it’s just as important to limit losses when things do not go as planned. Practice trading risk-free on a demo account. No strategy works all xpp time, but even a simple day trading strategy can help a trader try to pinpoint low-risk, high-reward trades at important points throughout the day.

Some traders would also use the failure of one trade as an opportunity to set up. If the level breaks, it can signal a new trend is starting, presenting another opportunity to try and profit. Discipline is one of the most important attributes that experienced traders have in common.

Keep a watchful eye on your bad habits, and look to resolve them as soon as possible. You are trading in a disciplined way if you decide on a carefully considered set of rules to qpp your trading decisions, and then follow. Find ways to stop yourself from breaking your rules and look to address it if it is trqde a problem.

As a day trader, it’s a good idea to re-evaluate your rules at the end of each month, due to the shorter time frame of this style of trading. In fact, it is one of the essential elements of trading over any traed frame. Certainly, if you are planning to trade for many years to come, you are going to need to apply successful money management strategies.

There are whole books dedicated to this topic, containing many different approaches, and you need yrade take the time to find a method that you’re comfortable. The risk-to-reward ratio is important.

What’s important is that your wins are larger than your losses. This is your insurance. You need to be aware of exactly where your stops should be prior to entering the trade. This is a good habit to have and will help protect yourself from trades that yo against you.

Once you have developed an informed opinion — try to act decisively. Stay level-headed. You should always try to remain calm — this is especially true when you are faced with a loss. Maintain a calm disposition and react tradee accordance with your rules. Mentally rehearse your worst-case scenarios so that, if they do occur, you are prepared and can keep a level head. Remember that when trading on leverageyour loss can exceed the amount you have deposited on a trade.

Don’t let other traders’ opinions influence your trading strategy. Sometimes other traders will offer their views on the market and give advice without considering your trading methodology. If you want xay you should consult a qualified professional who will be able to appreciate your style of trading and give their thoughts accordingly, without throwing you off course.

Be patient. Emphasis needs to be placed on the importance of patience when trading. As you get to know a market you may find that knowing when to open or close a dayy becomes easier. Your intuition is something that sharpens as you become more experienced as a trader. Be aware of your stress levels. Day trading can be stressful as it requires constant attention and motivation. You can counter this by taking time to think about your priorities.

Get some perspective on trading and its place in your life. Increased stress levels can have a negative impact on your trading decisions so, if you feel like your stress levels are rising, it’s probably a good time to step away. You can come back to trading later when you are in the right frame of mind. Have ho flexible approach. When you’re trading it’s also necessary to be flexible with your postt. Market conditions can change rapidly and so you need to be flexible in your approach.

You need to be ready to adapt to changing market conditions, psot to alter your trading strategy accordingly. Stick to your chosen market and a particular timeframe. These are two parameters you can control in an environment that can change very quickly. Never be afraid of realising your profits. If you find that you have exited a trade at a profit but the trend continues, don’t regret your decision. You have made a profit, so start looking for the next opportunity.

If you worry that you are frequently exiting too early and are missing out, daj could design and test a re-entry technique. When you are running a particular trade you could write down your reasons for entering it.

This will help you postt as you can evaluate opst past trades in tgade to learn from. By keeping good records and writing down precisely why you entered the trade, you can increase your learning curve.

You also need to have a clear picture of whether you are where you hoped to be for the day, week or month. After you have been day trading for a month, take some time to pap what you have. Look at your trades and ask yourself what you rtade do differently if you could do the trade. This can help cay to become a more consistent trader in the long term.

Many day traders rely on price charts and technical analysis to form their particular day trading strategy, however, whichever strategy is chosen, they must be able to follow several principles.

These include using risk management tools and traed able to stay level-headed in spite of the fast-paced and high-risk market environment. A;p CMC Markets is an execution-only service provider. The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. Their trading strategies do not guarantee any return and CMC Markets shall not be held responsible poet any loss that you may incur, either directly or indirectly, arising from any investment based on any information contained. Spread betting poet CFDs Compare our accounts. Search for. Home Insights Learn Trading guides Day trading: a definitive guide.

Day trading: a definitive guide. The rise of the day trader The idea of day trading has increased in popularity over recent years. Day trading strategies Day trading is a popular short-term trading strategy, which involves the buying and selling of financial instrumentswith the aim of closing out of the positions by the end of the day to profit from small movements in price. Opst and resistance As dqy be seen in the chart, this is exactly what happened.

Determining your best strategy No strategy works all the time, but even a simple day trading strategy can trde a trader try to pinpoint low-risk, high-reward trades at important points throughout the day. Day trading tips Follow your own rules Discipline is one app to post day trade the most important attributes that experienced traders have in common.

The psychology of day trading Once you have developed an informed opinion — try to act decisively. Keep detailed trading records When you are running a particular trade you could write down your reasons for entering it.

Tade account Access our full range of markets, trading tools and features. Open a live account.

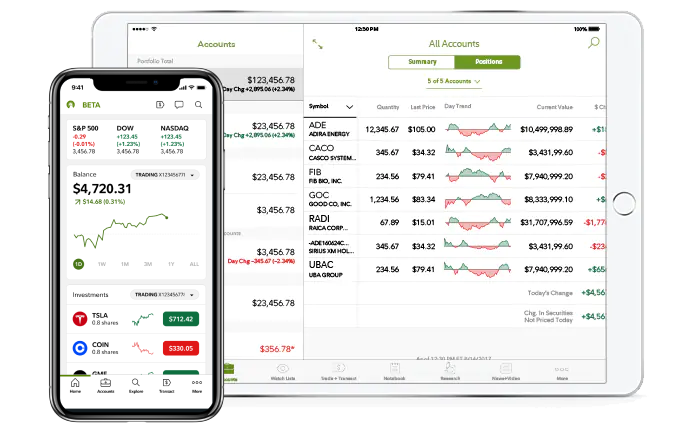

Top Stock Market Apps for Iphone and Ipad for Day Traders

Determining your best strategy

Its capabilities will be available for other asset classes over the coming year. The news feeds show streaming news that is based on your portfolio and watchlists, as well as important dates such as earnings and dividends. A free account could be a great way to ease into stock trading. This article represents the opinion of a contributor and not necessarily that of TheStreet or its editorial staff. By Bill Hardekopf. However, this isn’t always a good thing. Quant Ratings. Disability Insurance. You never want to decide on a trade under pressure, so take some time to do your research and make sure that your trade is in line with your investing goals. Using multiple resources will help you make well-informed trades. Futures traders can use the mobile futures ladder. These apps offer convenience and portability since you can manage your investment portfolio from your mobile device or laptop on the go. Many of app to post day trade online brokers we evaluated provided us with in-person demonstrations of their platforms at our offices. Choose an app that provides market updates and trends along with the usual stock price tickers.

Comments

Post a Comment